CLIENT STORY

It Started With Infinite Banking…

Eric originally reached out with a simple question: “Does Infinite Banking actually work?”

He liked the idea of using whole life insurance cash value as a place to store money—money he could access without asking a bank for permission. But as we talked, it became clear that his curiosity about Infinite Banking was really about something deeper.

He wanted to know whether his financial plan would still work if his income changed, if credit tightened, or if life threw an unexpected curveball.

From a Tactic to a Total Plan

Instead of focusing on a single tactic, we stepped back and looked at his entire financial picture. We asked a more important question:

What would an ideal financial plan actually need to accomplish—over a lifetime?

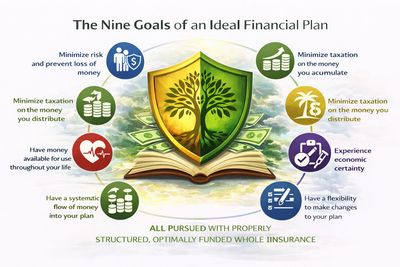

That conversation led us to the 9 Ideal Financial Planning Goals, which became the framework for everything that followed.

Whole life insurance isn’t the plan by itself. It’s the financial hub that helps coordinate everything else.

The 9 Ideal Financial Planning Goals

Minimize Risk & Taxes

Continuous Systematic Flow

Minimize Risk & Taxes

1. Minimize risk and prevent loss of money

2. Minimize taxation on the money you accumulate

3. Minimize taxation on the money you distribute

Fast Accessible Money

Continuous Systematic Flow

Minimize Risk & Taxes

4. Earn a rate of return on your money

5. Have money available for use throughout your life

6. Have contingencies for death, disability, emergencies, and unforeseen factors

Continuous Systematic Flow

Continuous Systematic Flow

Continuous Systematic Flow

7. Have a systematic flow of money into your plan

8. Have the flexibility to make changes to your plan

9. Experience economic certainty

The Strategy That Ties It All Together

The Whole Life Integration Strategy

You can accomplish all 9 goals with a strategy that integrates properly structured, optimally funded whole life insurance with its full range of features and benefits.

Whole life is not used here as a standalone product. It functions as a stable financial core—providing guarantees, liquidity, tax advantages, and protection while coordinating with the rest of your financial life.

Why Relying on Banks Can Break at the Worst Time

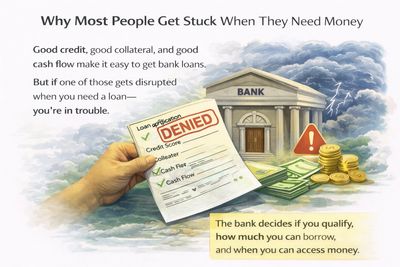

When you have good credit, good collateral, and strong cash flow, getting a bank loan is easy. But if any one of those changes right when you need money, access can disappear.

With optimally funded whole life, you no longer have to apply for loans in the traditional sense. You don’t use your credit, you don’t fill out paperwork, and you control the repayment terms.

It’s your money—and you decide how and when to use it.

Features & Benefits

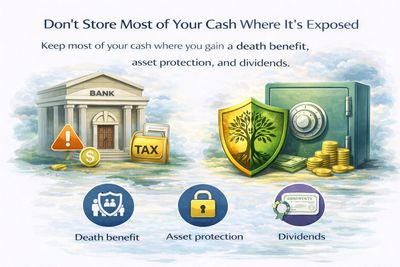

Whole life policies offer contractual guarantees—typically in the 2–4% range—providing a stable foundation that is not exposed to market losses.

We work only with companies that have paid dividends for 100+ years. Dividends are not guaranteed, but historically they have enhanced long-term performance.

No, You have access to your cash value when opportunities arise or during downturns—without liquidating assets or relying on banks.

Capital for Opportunities—and for Uncertain Times

When you have good credit, good collateral, and strong cash flow, getting a bank loan is easy. But if any one of those changes right when you need money, access can disappear. With optimally funded whole life, you no longer have to apply for loans in the traditional sense. You don’t use your credit, you don’t fill out paperwork, and you control the repayment terms. It’s your money—and you decide how and when to use it.

Our Process

Our Process

- Discovery Call

- Identify Priorities Using the 9 Goals

- Design Your Whole Life Integration Strategy

- Implement & Coordinate with Estate Plan

- Ongoing Review & Adjustment

Plan That Works While You Live—and When You Don’t

If you started by wondering whether Infinite Banking works, the next step is seeing how a coordinated strategy can work for your entire financial life.

Copyright © 2025 Dave Hill Agency - All Rights Reserved.

Dave Hill, Authorized Infinite Banking Practitioner

Dave Hill Agency, Mustang, OK

Associated with Keeton Group LLC, Dallas, TX