"I wish we'd planned for my life, not just his death. Before we always planned together. Now I have to plan alone and there isn't enough money."

Anonymous Widow

The best time to plant a tree was 20 years ago. The second best time is now.

Chinese Proverb

Eric & Heather’s Story

Eric and Heather already had a few small policies in place—some purchased through their auto insurance agent and some through Eric’s employer—but something still didn’t feel settled.

As a blended family with three children, they wanted confidence that each child would be financially cared for and treated fairly, no matter what the future held. At one point Eric admitted,

“I didn’t know what to do about wills, so we hadn’t done anything.”

They were also unsure how short-term protection compared to long-term solutions.

After Eric saw what happened to a co-worker who suffered a heart attack, Eric and Heather were worried about real-life risks—like what would happen if Eric faced a critical or chronic illness, not just an early death.

Disability was another major concern. Eric had disability income coverage at work, but it would only replace about 60% of his income—and only for five years. He was uneasy about what would happen to their overall plan if he became disabled and the coverage ended while expenses continued.

Looking ahead, they were also thinking about retirement. Eric’s employer matched his 2% contribution in a company 401(k), but he had a bigger question in mind: What would happen to his plan if he left the company to start his own business?

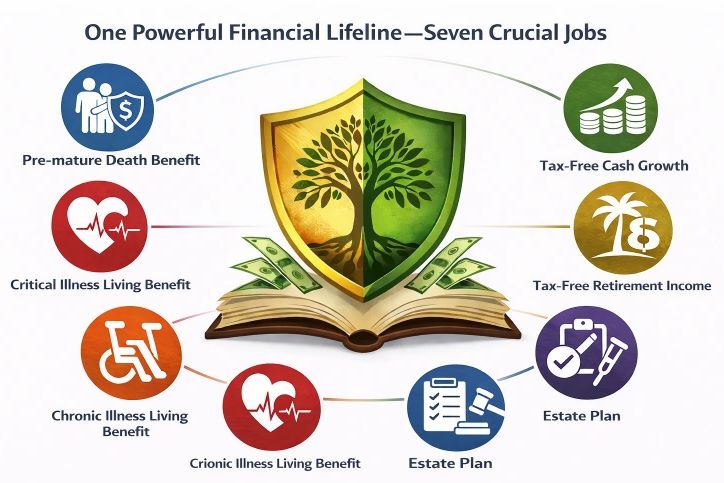

Together, we designed a tax-favored financial lifeline that addressed the seven concerns weighing on them: protecting their family if (1) Eric died too soon; providing cash in the event of a (2) critical illness or (3) chronic illness; continuing the plan even if Eric became (4) disabled; (5) creating accessible cash they could control; and supporting (6) long-term retirement goals—while also building flexibility for a future business transition. Everything was coordinated with (7) an estate plan for clarity and confidence.

As Eric later shared:

“I never knew how much peace of mind I would have knowing my family is protected and we have a plan going forward into retirement.”

or

Or, call me, 405-669-3544

“I never knew how much peace of mind I would have knowing my family is protected so many ways and we have a plan going forward into retirement.”

— Eric

Copyright © 2025 Dave Hill Agency - All Rights Reserved.

Dave Hill, Authorized Infinite Banking Practitioner

Dave Hill Agency, Mustang, OK

Associated with Keeton Group LLC, Dallas, TX